Key Takeaways

- 32% of homeowners underestimated the cost of energy efficiency upgrades, with 1 in 5 facing unexpected expenses over $2,000 and nearly 1 in 10 paying more than $5,000.

- Despite the cost, over 90% of homeowners don’t regret their energy efficiency upgrades.

- 50% of homeowners delayed or canceled energy efficiency upgrades due to financial concerns, with Gen Z (50%) being the most impacted by rising interest rates.

- Nearly 2 in 5 homeowners were unaware of available government rebates, tax credits, or financing options for energy-efficient home upgrades.

- If low-interest financing or on-bill repayment options were more accessible, 80% of homeowners would proceed with energy efficiency upgrades.

- 56% believe homeowners should receive financial benefits, such as lower mortgage rates or property tax reductions, for investing in energy-efficient upgrades.

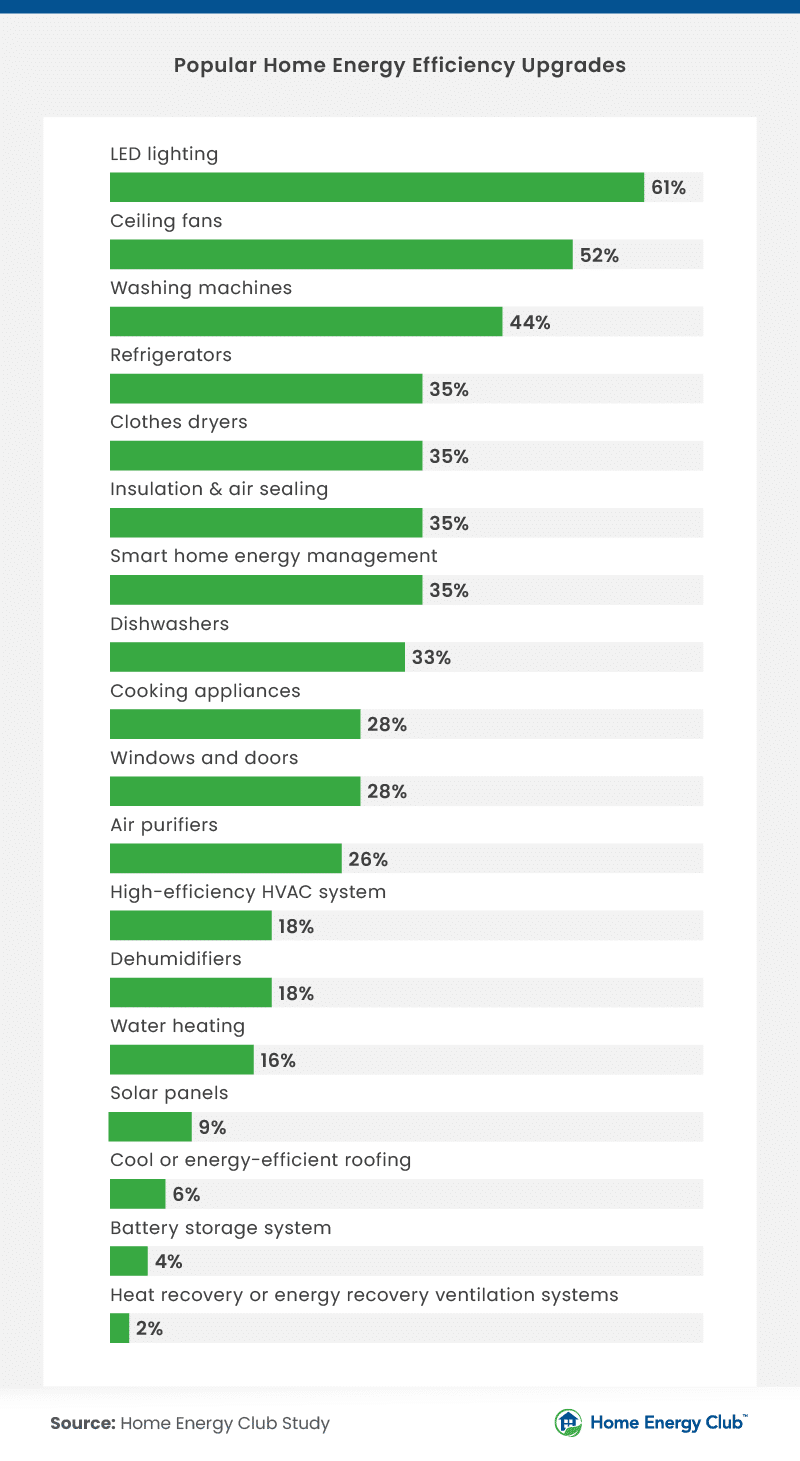

Home Upgrades That Deliver Fast Energy Savings

Energy-efficient upgrades can lead to big savings, but some pay off faster than others. Here are the top choices among American homeowners, the ones they say offer the quickest return on investment, and their average monthly savings.

Homeowners identified these upgrades as the fastest ways to save on energy costs:

- Insulation and air sealing

- LED lighting

- Smart home energy management (smart thermostats, power strips, automated lighting and appliances)

- Windows and doors (double-pane, storm windows, low-E coatings)

- Washing machines

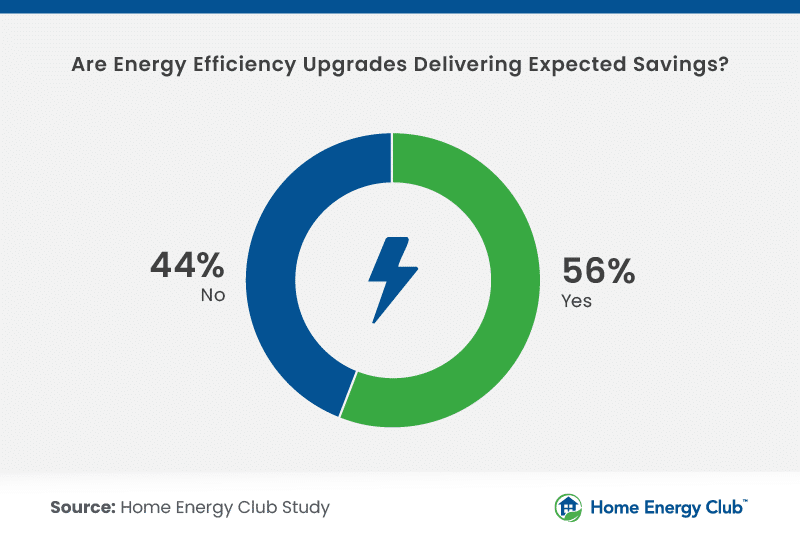

Many American homeowners saw real savings after investing in energy-efficient upgrades. On average, they cut $50 from their monthly energy bills. For some, the benefits were even greater: 1 in 5 reported saving $75 per month, while 1 in 7 saved $100 or more.

Average Monthly Savings by Upgrade:

| Solar panels | $117 |

| Battery storage system (for solar energy) | $98 |

| High-efficiency HVAC system | $71 |

| Windows and doors (double-pane, storm windows, low-E coatings) | $68 |

| Cool or energy-efficient roofing | $64 |

| Water heating (tankless, heat pump, solar) | $62 |

| Refrigerators | $59 |

| Insulation & air sealing | $58 |

| Clothes dryers | $54 |

| Cooking appliances (induction cooktops, convection ovens, microwaves) | $53 |

| Washing machines | $50 |

| Smart home energy management (smart thermostats, power strips, automated lighting and appliances) | $50 |

| Dehumidifiers | $44 |

| Air purifiers | $43 |

| Ceiling fans | $42 |

| Dishwashers | $42 |

| LED lighting | $39 |

While most homeowners agreed that their energy-efficiency investments were worthwhile — over 90% had no regrets — expectations on payback periods varied. On average, Americans anticipated it would take 7 years for energy savings to cover their upgrade costs. However, nearly 3 in 5 believed they would break even within 5 years, while more than 1 in 3 expected it to take a decade or longer.

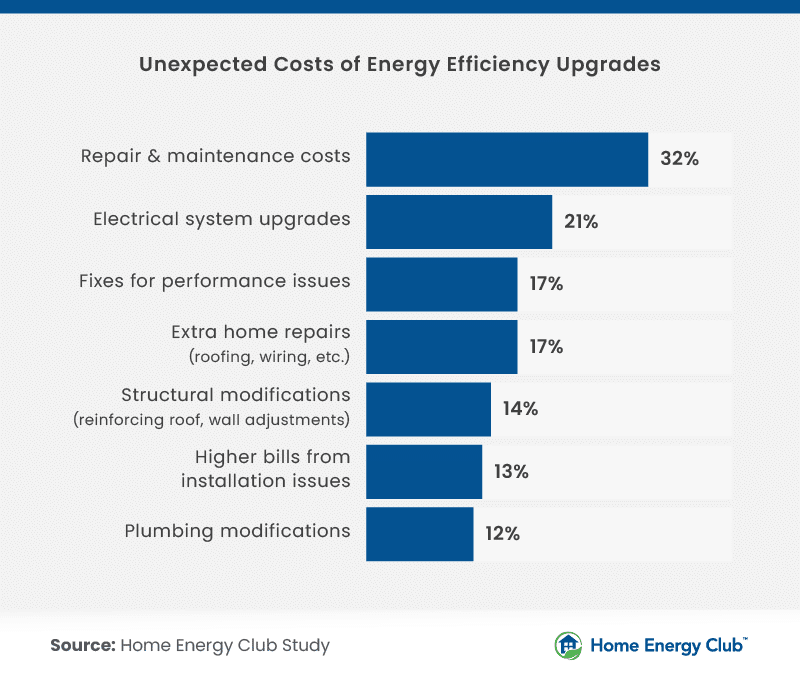

The Hidden Costs of Energy Efficiency Upgrades

Though energy-efficient upgrades can lead to long-term savings, some homeowners underestimated the upfront costs. Nearly one-third (32%) miscalculated expenses, and just over 1 in 10 faced unexpected costs, averaging $600. For some, the financial impact was even greater — 1 in 5 paid more than $2,000, and nearly 1 in 10 spent over $5,000.

The likelihood of unexpected costs often depended on the home’s age. Homes built between 1980 and 1999 were the most likely to have unforeseen expenses (17%), while those built after 2000 had the lowest rate (9%). Older homes saw the highest financial impact, with properties built before 1950 averaging $895 in surprise costs.

Despite these unexpected expenses, most homeowners felt their investment was worth it — 9 in 10 said they would still choose to make the same energy-efficient upgrades.

The Financial Barriers To Energy Efficiency Upgrades

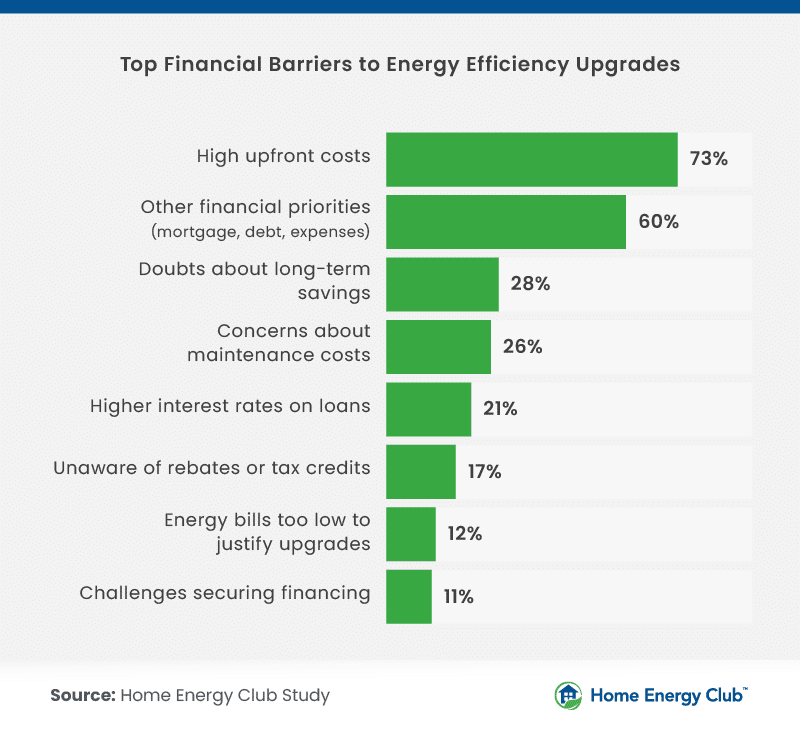

Homeowners ranked high upfront costs as the biggest barrier to having a more energy-efficient home, followed by competing financial priorities, such as mortgage payments, debt, and other household expenses.

Half of all homeowners — and over 50% of Gen Z ones — said financial concerns have prevented them from making upgrades. Rising interest rates also made things harder, with nearly 2 in 5 homeowners delaying or canceling energy-efficient improvements because of them. For Gen Z homeowners, that number jumped to almost 50%. Most (4 in 5) said they would invest in energy-efficient upgrades if low-interest financing or government subsidies were easier to access.

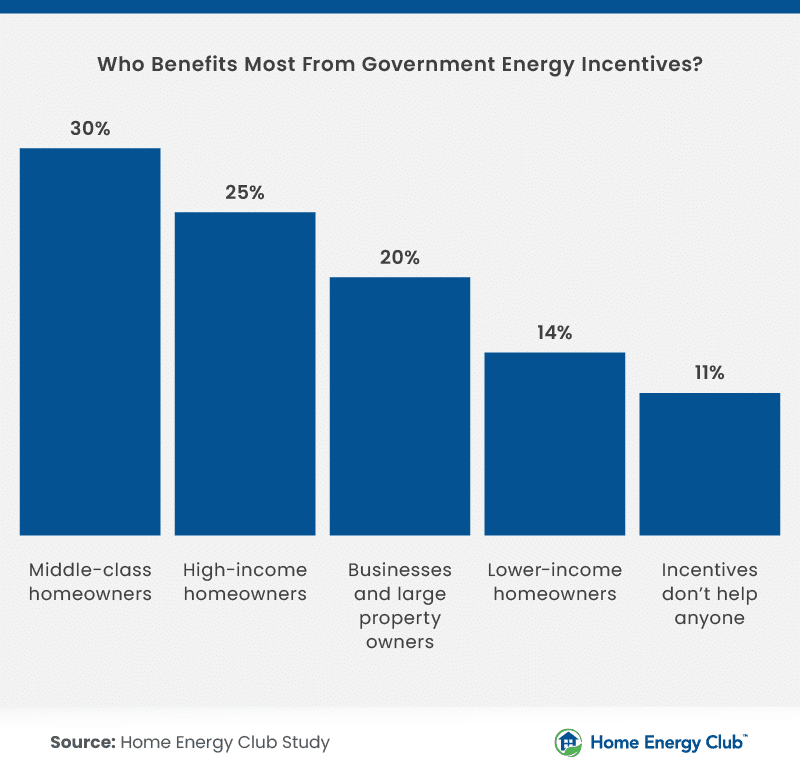

Overall, people thought that government energy incentives benefit middle-class homeowners the most. Yet, baby boomers and Gen Z (28%) saw high-income homeowners as the primary beneficiaries of government energy incentives. More than 1 in 10 homeowners, including 15% of baby boomers and Gen Xers, thought they helped no one. Just 8% of millennials and 3% of Gen Z said the same.

Nearly 2 in 5 Americans were unaware of government rebates, tax credits, or financing options, and 2 in 3 said they might have upgraded sooner had they been better informed.

Over 80% of Americans supported some form of financial incentive for energy-efficient homes. More than half (56%) believed homeowners should receive benefits like lower mortgage rates or property tax reductions. However, 16% said energy efficiency should not impact mortgage rates or property taxes, and 28% thought incentives should only apply to major upgrades such as solar panels, HVAC systems, or insulation.

Balancing Costs and Benefits in Energy Efficiency

Energy efficiency upgrades can lead to significant savings, but the path isn’t always straightforward. Many homeowners underestimate initial costs, while financial constraints — such as high upfront expenses and rising interest rates — delay their plans. Despite these challenges, most homeowners see the long-term benefits, reporting noticeable savings and little regret over their investments. With greater awareness and better access to rebates and financing, energy efficiency upgrades could become a more practical option for homeowners nationwide.

Methodology

We surveyed 1,003 American homeowners to analyze the real financial impact of energy efficiency upgrades. The generational breakdown of respondents was as follows: Gen Z (8%), millennials (47%), Gen X (31%), and baby boomers (14%). Survey data was collected on February 17, 2025. Some percentages throughout may not total exactly 100% due to rounding.

About Home Energy Club

Home Energy Club helps consumers find the best electricity rates while promoting energy-efficient living. By offering unbiased provider reviews and tools for comparing plans, the platform empowers homeowners and renters to reduce costs and avoid hidden fees. With a focus on transparency and savings, Home Energy Club simplifies the process of making smarter energy decisions.

Fair Use Statement

Noncommercial sharing of these insights is permitted if proper credit is given via a link.